RAJA5K: Situs Terpercaya untuk Bermain Slot Gacor

RAJA5K adalah situs terpercaya yang menyediakan beragam permainan slot gacor untuk para penggemar judi online. Dengan reputasinya yang telah terpercaya, RAJA5K telah menjadi raja dalam hal permainan slot gacor. Apakah Anda mencari slot dengan tingkat kemenangan yang tinggi? RAJA5K adalah tempat yang tepat untuk Anda. Slot Gacor Maxwin

Dalam Raja Slot Gacor, Anda dapat menikmati hingga 5 game slot gacor setiap harinya. Ini memungkinkan Anda untuk memilih dan bermain game yang paling sesuai dengan preferensi Anda. Dari tema klasik hingga motif modern, RAJA5K menawarkan berbagai pilihan permainan yang pasti akan memenuhi selera Anda.

Untuk bergabung dengan RAJA5K dan menikmati pengalaman bermain slot gacor yang tak terlupakan, Anda hanya perlu mengikuti beberapa langkah mudah untuk mendaftar. Dengan daftar slot gacor di RAJA5K, Anda dapat merasakan sensasi kemenangan besar hingga 5000 keping rupiah. Jadi, jangan lewatkan kesempatan ini dan daftarkan diri Anda sekarang juga di RAJA5K!

Situs Raja5K sebagai Pilihan Terpercaya

Raja5K merupakan situs terpercaya yang menyediakan berbagai permainan slot gacor. Dengan reputasi yang baik dan pengalaman yang luas, Raja5K menawarkan kesempatan kepada para pemain untuk memenangkan hadiah besar setiap harinya. Bukan hanya menjadi salah satu situs terbaik untuk bermain slot gacor, Raja5K juga dikenal dengan keamanannya yang terjamin.

Dengan bermain di Raja5K, Anda akan mengalami pengalaman bermain yang tak terlupakan. Anda dapat menikmati 5 game slot gacor terbaik setiap harinya, yang dikemas dengan grafik yang menawan dan fitur-fitur menarik. Keberagaman game yang ditawarkan, serta kualitasnya yang tinggi, membuat Raja5K menjadi pilihan yang tepat bagi para pecinta slot gacor.

Selain itu, cara daftar slot gacor 5000 di Raja5K juga tidaklah sulit. Proses pendaftaran yang sederhana dan cepat akan memberikan akses langsung kepada Anda untuk segera memulai petualangan bermain slot gacor. Tidak hanya itu, Raja5K juga menyediakan berbagai metode pembayaran yang aman dan mudah, sehingga Anda dapat melakukan deposit dan penarikan dengan nyaman.

Raja5K sebagai situs Raja Slot Gacor terpercaya telah terbukti memberikan kepuasan kepada para pemainnya. Dukungan pelanggan yang ramah dan responsif juga menjadi nilai tambah dari Raja5K. Jadi, tunggu apa lagi? Bergabunglah sekarang dan rasakan kemenangan di jari-jari Anda dengan bermain di Raja5K!

5 Game Slot Gacor Tersedia di Raja5K

Di Raja5K, terdapat 5 game slot gacor yang bisa Anda mainkan dengan mudah dan menguntungkan. Dengan hadirnya game-game ini, Anda dapat merasakan sensasi bermain slot yang tak terlupakan. Berikut adalah daftar game slot gacor yang tersedia di Raja5K.

-

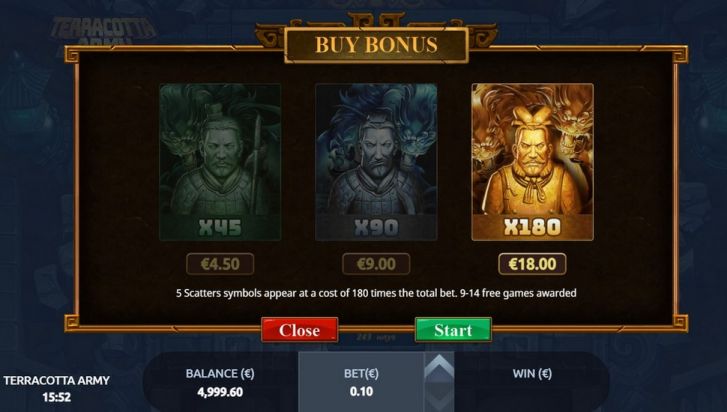

Game Slot "Max Win Club"

Game slot ini menawarkan keseruan dan kesempatan untuk meraih kemenangan besar. Dengan fitur-fitur unggulan dan grafis yang menarik, game ini dapat menjadi pilihan yang tepat bagi penggemar slot online. Mainkan game "Max Win Club" di Raja5K dan raih kemenangan menggiurkan! -

Game Slot "Mega Jackpot"

Apabila Anda sedang mencari game slot dengan jackpot besar, "Mega Jackpot" adalah pilihan yang tepat. Dengan kombinasi simbol yang tepat, Anda berpotensi memenangkan hadiah jackpot yang menggiurkan. Rasakan sensasi mendebarkan dari game "Mega Jackpot" di Raja5K. -

Game Slot "Super 777"

Bagi Anda yang menyukai kombinasi klasik pada game slot, "Super 777" adalah jawabannya. Kombinasikan simbol 777 untuk meraih kemenangan yang luar biasa. Nikmati sensasi permainan slot klasik dengan tampilan yang menarik di Raja5K. -

Game Slot "Golden Dragon"

Game slot dengan tema Asia ini menawarkan kesempatan untuk memenangkan kemenangan besar. Dengan simbol-simbol khas seperti naga emas, game "Golden Dragon" memberikan pengalaman bermain yang menghibur dan mengasyikkan. Mainkan game ini di Raja5K dan rasakan keberuntungan Anda. -

Game Slot "Lucky Gems"

Game slot yang menghadirkan berbagai batu permata ini menawarkan kesempatan untuk meraih kemenangan yang gemilang. Dengan tampilan yang menawan dan fitur-fitur bonus yang menguntungkan, game "Lucky Gems" memiliki daya tarik tersendiri. Jelajahi keindahan batu permata di Raja5K dan rasakan keberuntungan Anda.

Tunggu apa lagi? Jangan lewatkan kesempatan untuk mencoba 5 game slot gacor ini di Raja5K. Daftarkan diri Anda sekarang dan nikmati sensasi bermain slot yang seru dan menguntungkan! Cara daftar slot gacor 5000 di Raja5K juga dapat Anda temukan di artikel berikut.

Cara Daftar Slot Gacor 5000 di Raja5K

-

Langkah pertama untuk mendaftar di Raja5K adalah kunjungi situs resmi mereka di RAJA5K. Setelah itu, cari tombol "Daftar" yang terletak di pojok kanan atas halaman utama.

-

Setelah menemukan tombol "Daftar," klik pada tombol tersebut. Anda akan diarahkan ke halaman pendaftaran. Isi formulir pendaftaran dengan data diri yang lengkap dan benar, seperti nama lengkap, tanggal lahir, alamat email, dan nomor telepon aktif.

-

Setelah mengisi formulir pendaftaran, pastikan untuk memeriksa kembali data yang Anda masukkan. Jika sudah yakin semua data yang Anda berikan benar, klik tombol "Daftar" untuk menyelesaikan proses pendaftaran. Selamat, Anda telah berhasil mendaftar di Raja5K!

Ingatlah untuk selalu memeriksa syarat dan ketentuan yang berlaku di Raja5K sebelum Anda mulai bermain slot gacor. Semoga artikel ini bermanfaat dan membantu Anda dalam memulai perjalanan bermain slot gacor di Raja5K. Selamat bermain dan semoga mendapatkan kemenangan yang banyak!